CAPITAL EQUIPMENT DEPRECIATION COULD CHANGE NEXT YEAR: THE TIME TO ACT IS NOW!

What is shaping up to be an apparent election victory for Joe Biden, there is an important change that will likely be taking place in tax planning - especially for businesses struggling to stay afloat during the Covid-19 crisis. Tax planning for current year 2020 and beyond should be a priority for businesses and individuals. Businesses that don’t plan wisely for the phase-out of the Section 179 tax deduction could be setting themselves up for unexpected tax liabilities when the benefit expires..

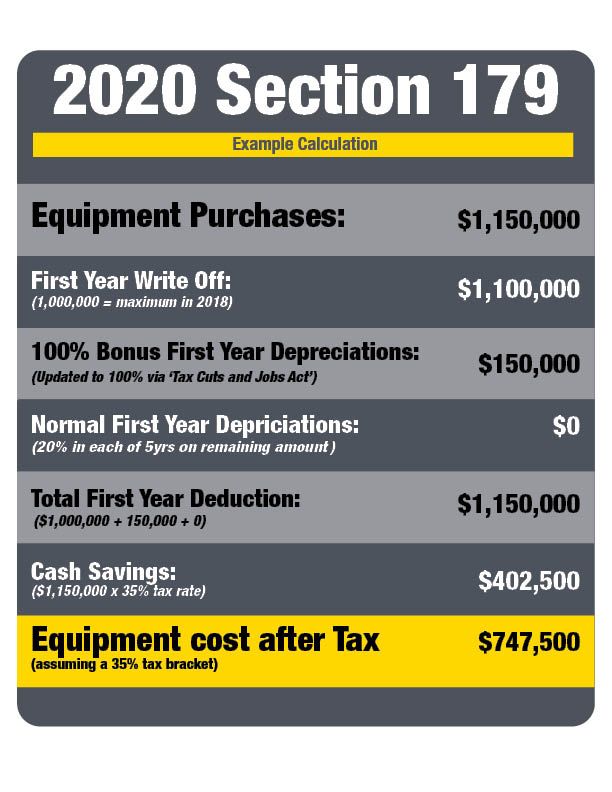

Here’s How Section 179 works:

In the past, when your business purchased qualifying assets, it typically wrote them off a little at a time through depreciation. If your company spent $50,000 on capital equipment, it was able to take a tax deduction of $10,000 a year for five years as an example through depreciation allowances. Businesses today, under Section 179 guidelines are able to expense the entire equipment purchase price the same year they bought it for the current tax year.

With the above explanation in mind, if Section 179 deductions are significantly modified or wholly repealed, then prior TCJA law (the PATH Act) would be in effect which could result in the elimination of this valuable bonus depreciation. Businesses that don’t plan wisely for the phase-out of this tax advantage could be setting themselves up for unexpected tax liabilities at a time when they least expect it.

How Can You Prepare for This Change?

Section 179 tax code benefits can vanish in an instant, so be sure to take advantage of this valuable depreciation benefit now while it’s still available. Meet with your professional tax preparer and start planning those capital equipment purchases before time runs out. Like they say, “Use it, or lose it!”

Want more information on Section 179?